Sales Tax By State Map – Sales tax is levied under the authority of both Central government as well as state governments. This tax is levied basically on trading of goods within the states. Works of contracts and leases are . But because it is a difficult tax to collect, as of 2011, a few states such as California, North Dakota, Kansas, Kentucky, Colorado and Illinois now require some online businesses to charge their .

Sales Tax By State Map

Source : taxfoundation.org

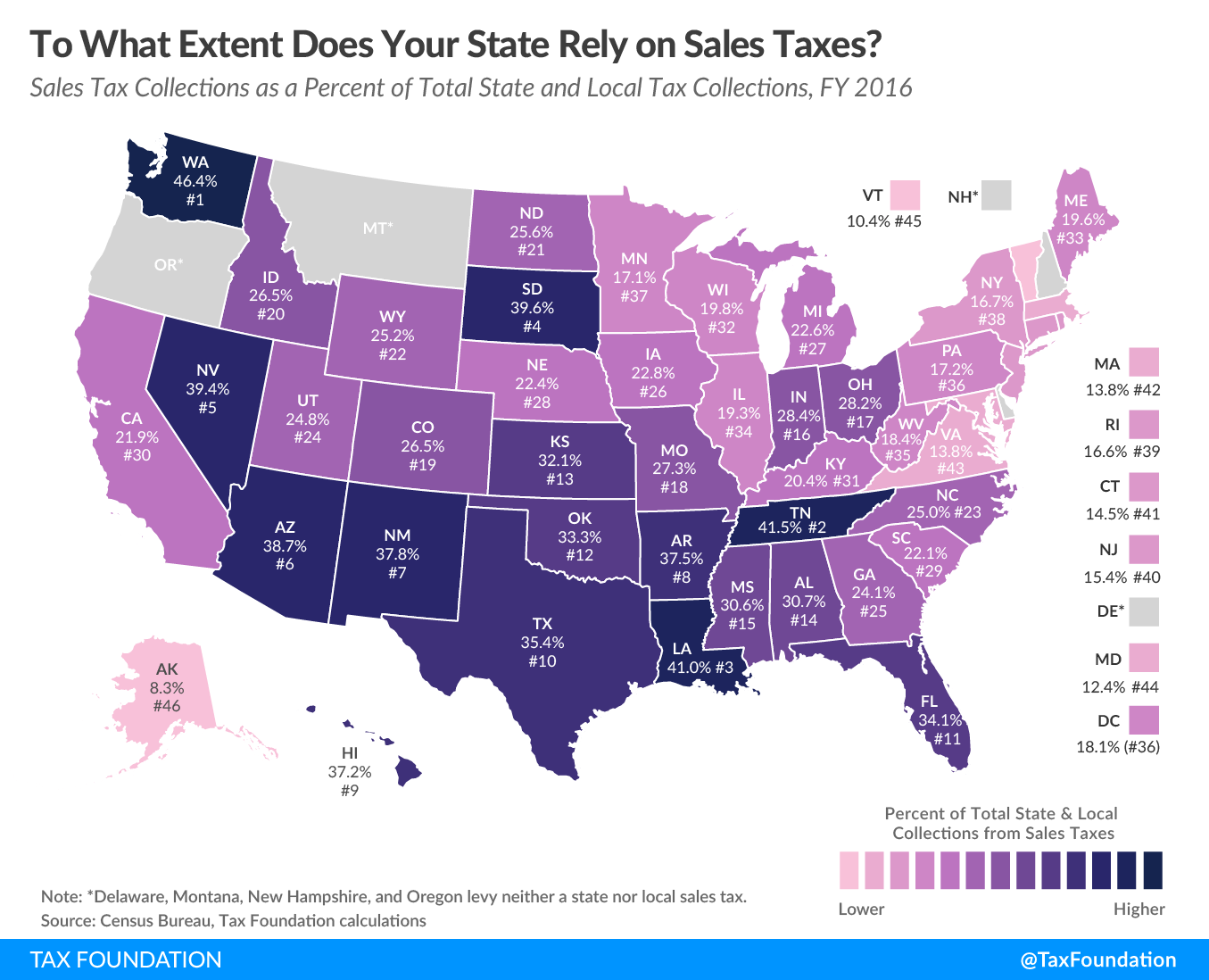

State Sales Tax | To What Extent Does Your State Rely on Sales Taxes?

Source : taxfoundation.org

2021 Sales Tax Rates | State & Local Sales Tax by State | Tax

Source : taxfoundation.org

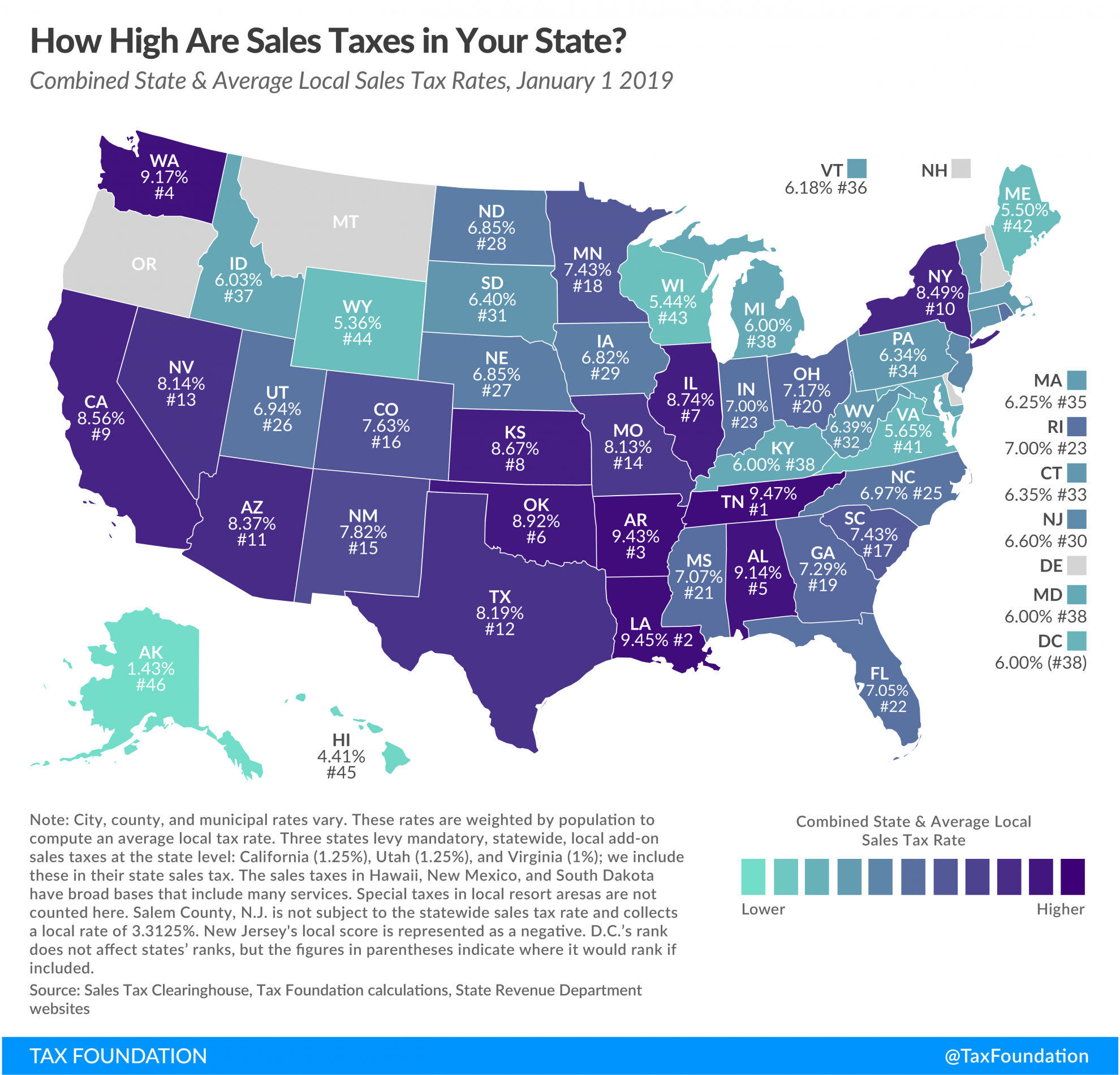

State and Local Sales Tax Rates, 2019 | Tax Foundation

Source : taxfoundation.org

Sales taxes in the United States Wikipedia

Source : en.wikipedia.org

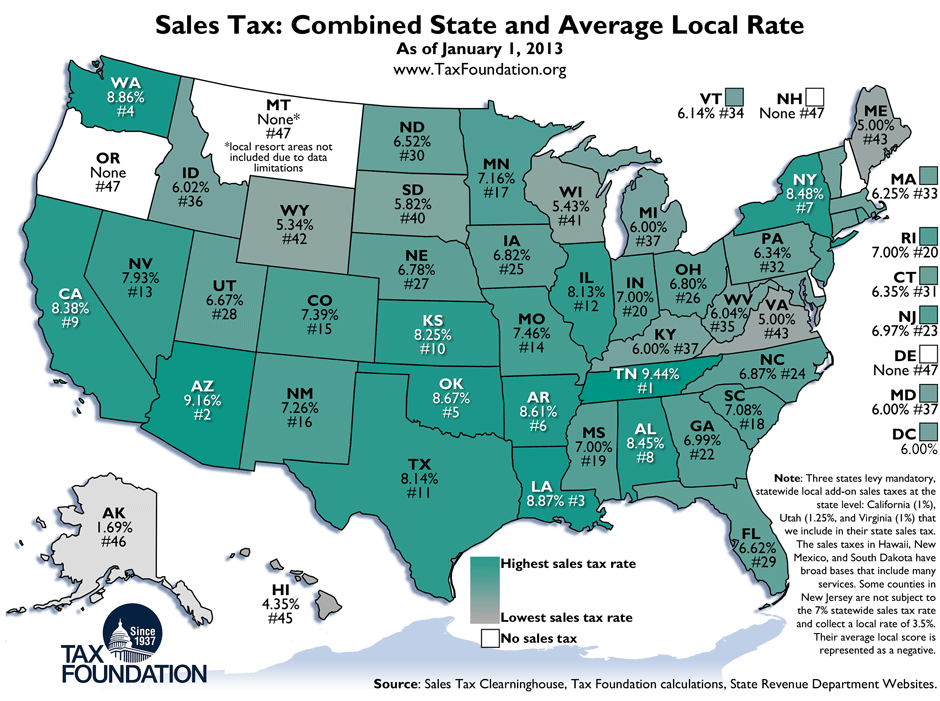

Weekly Map: State and Local Sales Tax Rates, 2013

Source : taxfoundation.org

Map: States With No Sales Tax and the Highest, Lowest Rates | Money

Source : money.com

Monday Map: State Sales Tax Rates

Source : taxfoundation.org

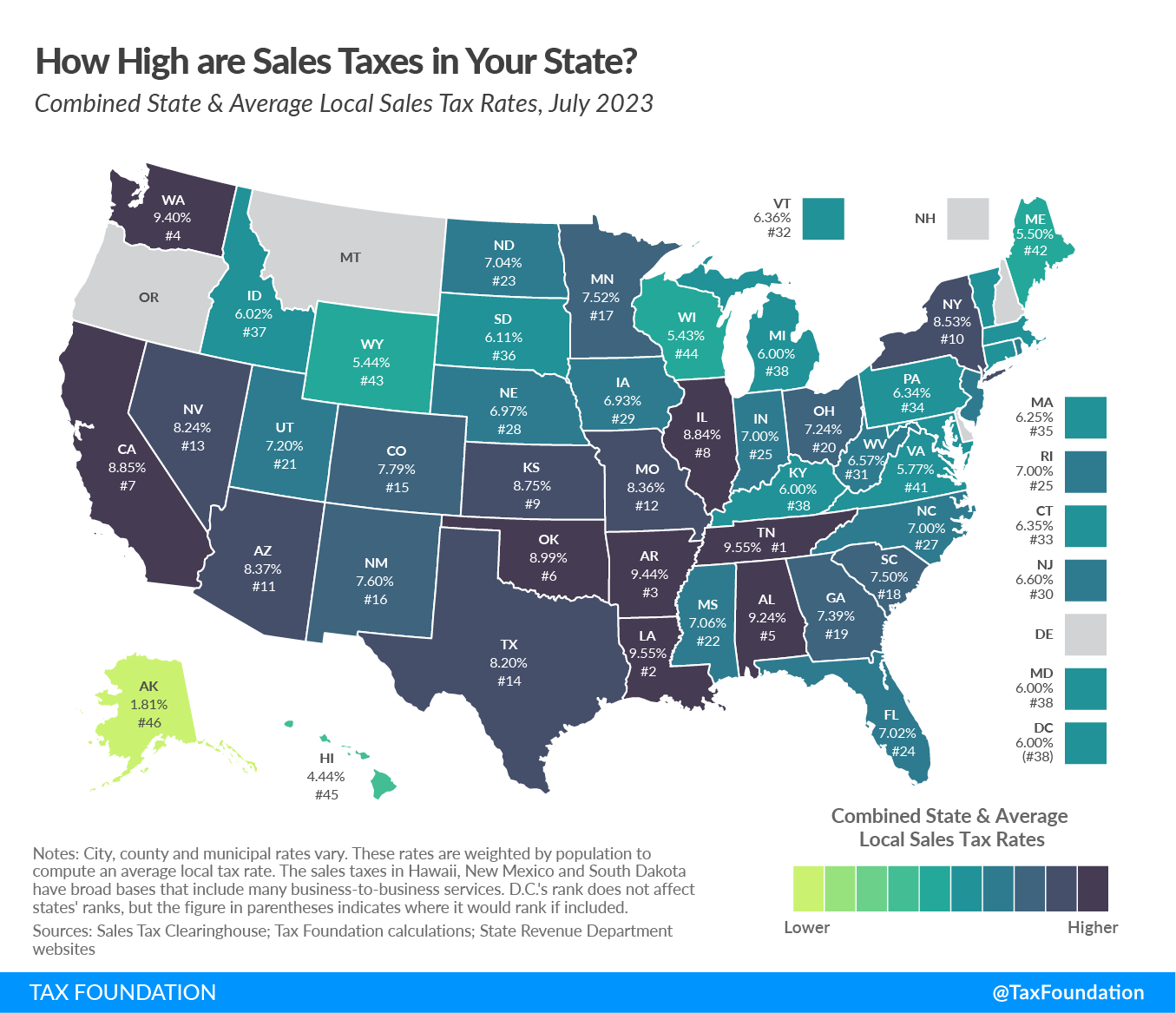

State and Local Sales Tax Rates, Midyear 2023

Source : taxfoundation.org

Map: State Sales Taxes and Clothing Exemptions

Source : taxfoundation.org

Sales Tax By State Map 2022 Sales Tax Rates: State & Local Sales Tax by State | Tax : We’ve put together the 10 most important things you should know about sales tax in order to help you navigate this confusing topic as you establish your Shopify store. 1. The State Governs Sales Tax . As a non-resident, you are required to pay tax on the sale of the ancestral property in Mumbai, similar to a resident. .

_0.png)